Mastering Bookkeeping for Small Businesses

Bookkeeping is the backbone of any successful small business. It involves recording, organizing, and managing financial transactions, which is crucial for strategic decision-making and overall growth. In this article, we will explore the intricacies of bookkeeping for small businesses, discuss its benefits, and offer practical advice to optimize your financial management.

Understanding Bookkeeping for Small Businesses

At its core, bookkeeping is a systematic process that ensures every financial transaction is documented and classified. For small business owners, having a robust bookkeeping system means you can:

- Track Income and Expenses: Know exactly where your money is coming from and where it's going.

- Prepare Accurate Financial Statements: Generate balance sheets, profit and loss statements, and cash flow statements to assess the business health.

- Stay Compliant: Ensure that you meet tax obligations and avoid penalties.

- Make Informed Decisions: Use financial data to guide your business strategies.

Why Bookkeeping is Essential for Small Businesses

The significance of bookkeeping cannot be overstated. Here are several reasons why small business owners should prioritize keeping their books in order:

1. Financial Visibility

When your financial records are organized, you gain clear visibility into your business's financial position. This transparency allows you to:

- Identify profitable services or products.

- Spot trends and seasonality in your business revenue.

- Recognize areas where you can cut costs.

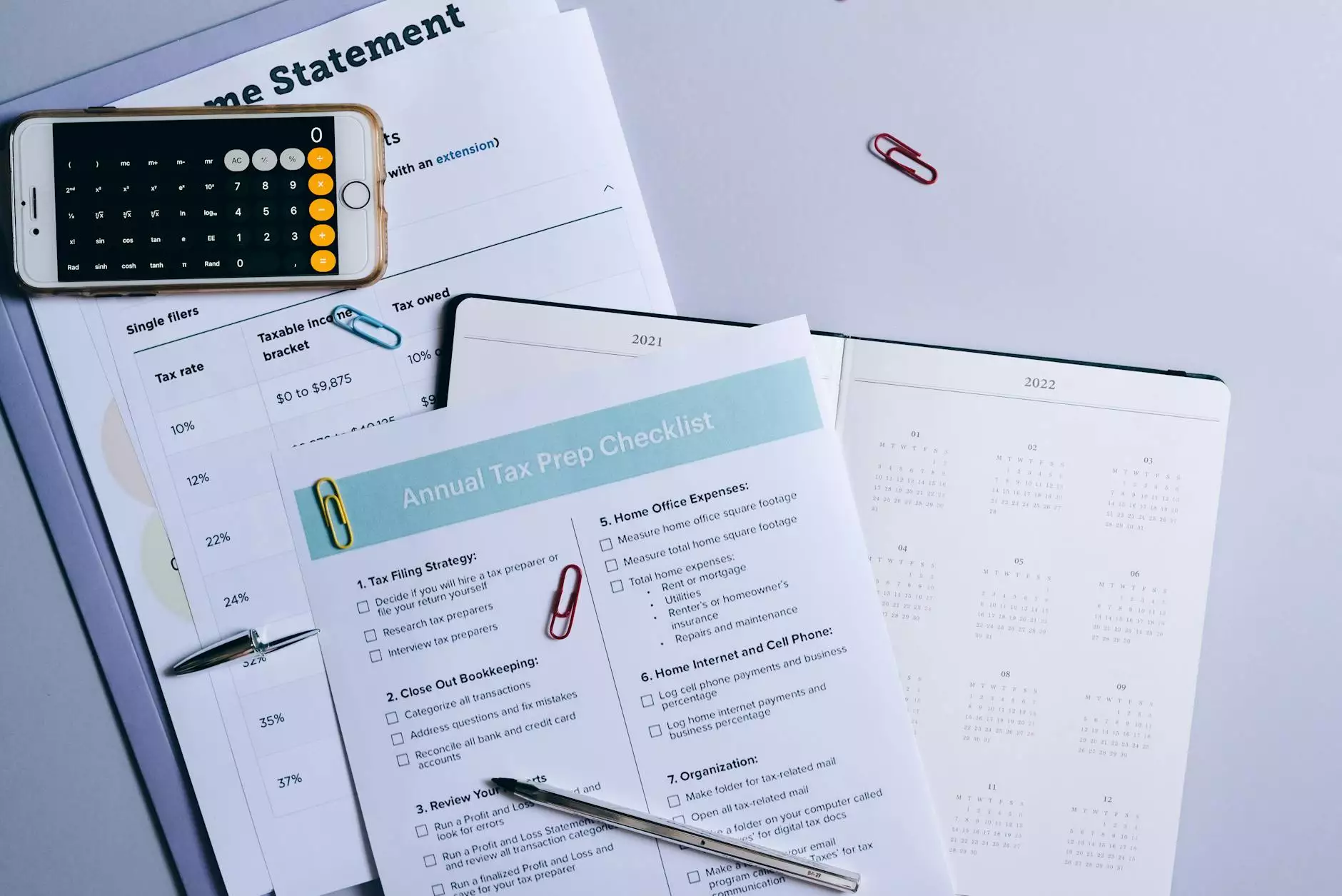

2. Streamlined Tax Preparation

Tax season can be stressful for many small business owners. A comprehensive bookkeeping system allows for:

- Easy retrieval of business expenses and receipts.

- Better organization for claiming deductions.

- A smoother process during tax audits if they occur.

3. Enhanced Cash Flow Management

Monitoring cash flow is vital for survival. Bookkeeping can help you:

- Predict cash flow shortages.

- Optimize payment terms with suppliers.

- Manage invoicing and collections more effectively.

Essential Bookkeeping Practices for Small Businesses

To effectively manage your small business finances, adopting these bookkeeping practices is crucial:

1. Choose the Right Bookkeeping Method

There are two primary methods of bookkeeping: single-entry and double-entry.

- Single-entry system: Best suited for sole proprietors or small businesses with straightforward transactions.

- Double-entry system: More complex but provides a comprehensive view of your finances and helps prevent errors.

2. Keep Personal and Business Finances Separate

One of the simplest yet most effective practices is to keep your business and personal expenses separate. This helps you maintain accurate records and simplifies tax prep.

3. Regularly Reconcile Accounts

Perform monthly reconciliations of your accounts to ensure that your records match bank statements. This practice is essential for identifying discrepancies and preventing fraud.

4. Utilize Bookkeeping Software

Investing in reliable bookkeeping software can significantly enhance your efficiency. Tools like QuickBooks, Xero, or FreshBooks offer features that can simplify invoicing, expense tracking, and reporting.

Outsourcing vs. In-House Bookkeeping: What’s Best for Your Small Business?

Deciding whether to outsource your bookkeeping to professionals or keep it in-house can significantly impact your business operations.

Benefits of Outsourcing

- Expertise: Access to experienced professionals who understand the nuances of accounting.

- Cost-Effective: Outsourcing can save you the overhead costs associated with hiring an in-house bookkeeper.

- Focus on Core Operations: By delegating bookkeeping tasks, you can concentrate on growing your business.

Benefits of In-House Bookkeeping

- Immediate Access: Having a bookkeeper on-site allows for instant information retrieval.

- Control: You maintain direct oversight of your financial data.

- Tailored Processes: You can develop specific processes that fit your unique business model.

Common Bookkeeping Mistakes to Avoid

Even with the best intentions, small business owners can make bookkeeping errors that can have serious consequences. Here are common pitfalls to avoid:

1. Neglecting Receipts

Filing receipts for business expenses is crucial for tax deductions. Losing receipts can lead to missed savings.

2. Failing to Backup Data

Data loss can be catastrophic. Regularly backing up your financial data ensures you won't lose important records.

3. Relying on Memory

Don’t attempt to remember transactions. Always document all income and expenses as they occur to ensure accuracy.

Leveraging Technology for Better Bookkeeping

Today’s technology has transformed bookkeeping for small businesses. Here are some ways tech can help:

1. Cloud-Based Solutions

Utilizing cloud-based accounting software allows you to access your financial data from anywhere, facilitating remote work and collaborative efforts.

2. Automation

Automating repetitive tasks (like invoicing) saves time and reduces errors, thereby streamlining your bookkeeping processes.

3. Real-Time Reporting

Modern software tools offer real-time reporting features that help you make quick, informed decisions affecting your business operations.

Conclusion: Take Charge of Your Small Business Bookkeeping

Effective bookkeeping for small business owners is essential for achieving financial success and sustainability. By adopting best practices, leveraging technology, and understanding the significance of bookkeeping, you can ensure your business is on the path to growth. Whether you're considering outsourcing your bookkeeping or managing it in-house, staying organized and informed will allow you to make the most effective and strategic decisions for your business's future at Booksla.

book keeping small business