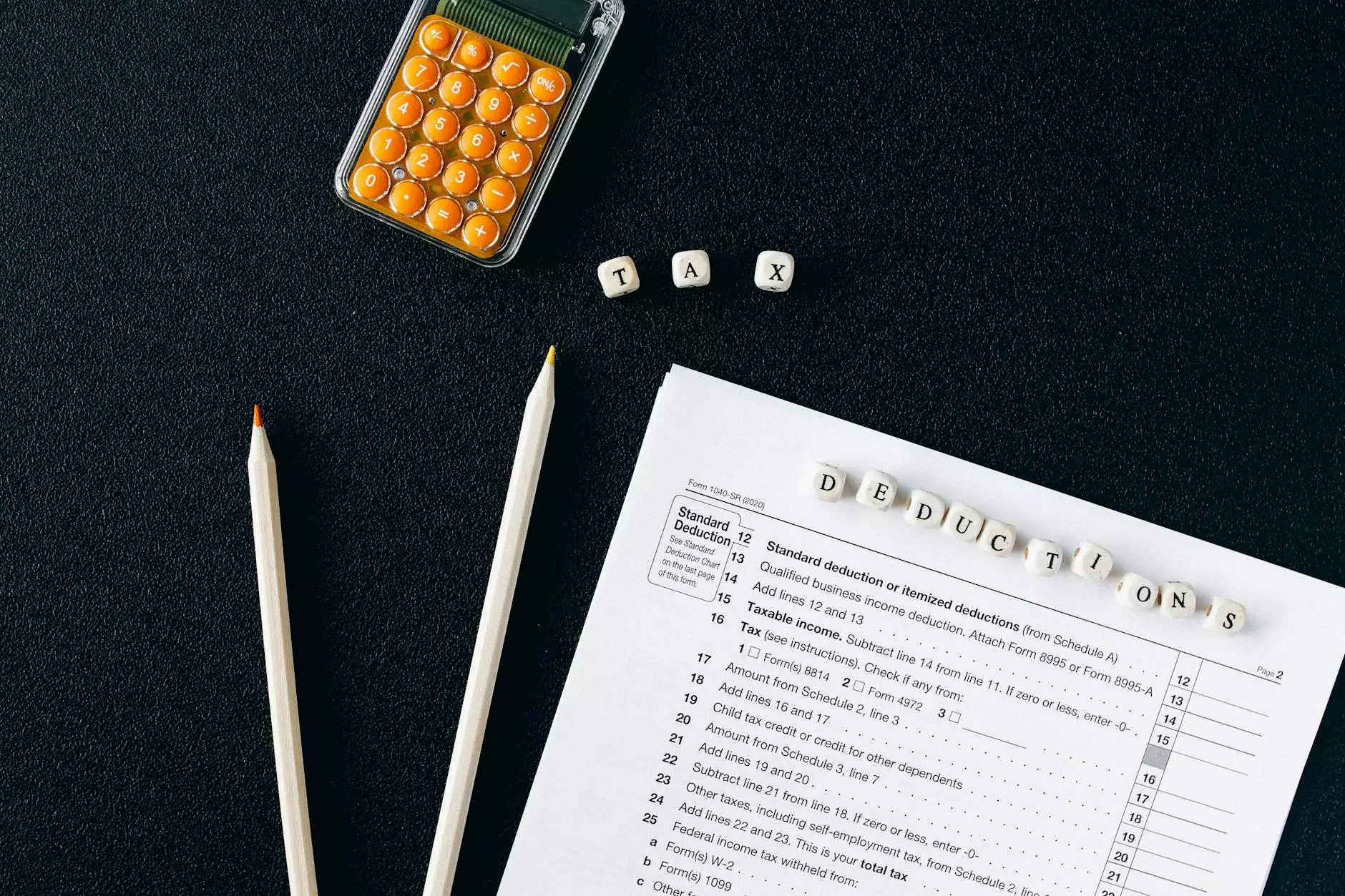

3 POWERFUL Tax Deductions You Should Use to Massively Reduce Your Taxes

Blog

Introduction

Discover the top 3 tax deductions that can have a massive impact on reducing your taxes. At Web ID Pro, we specialize in providing business and consumer services with a focus on website development. Our team of experts has researched and compiled these valuable tax deduction strategies to help you maximize your savings.

1. Home Office Deduction

The home office deduction is a powerful tax strategy for small business owners and self-employed individuals. If you use a portion of your home exclusively for your business activities, you may be eligible to deduct expenses related to your home office.

To qualify for this deduction, the space in your home must be your primary place of business, used regularly and exclusively for business purposes. Eligible expenses may include mortgage or rent payments, utilities, and maintenance costs.

It's important to maintain accurate records and ensure that your home office deduction complies with IRS guidelines. Working with a qualified tax professional, like Web ID Pro, can help ensure you take full advantage of this deduction while avoiding any potential red flags.

2. Business Vehicle Expenses

If you use a vehicle for business purposes, you can potentially deduct a portion of the expenses associated with owning and operating that vehicle. This can include fuel costs, insurance premiums, maintenance and repairs, as well as lease or loan payments.

To qualify for the business vehicle expense deduction, you must keep detailed records of your business-related mileage and expenses. This includes tracking the purpose of each trip, the total miles driven, and the total expenses incurred.

Web ID Pro understands the complexities of calculating and maximizing your business vehicle expense deduction. Our team of experts can help you navigate through the IRS regulations to ensure you're capturing all eligible expenses and minimizing your tax liability.

3. Retirement Plan Contributions

Contributing to a retirement plan not only helps secure your financial future but can also provide significant tax advantages. By making contributions to a tax-advantaged retirement account, such as a 401(k) or IRA, you may be able to lower your taxable income.

Depending on the retirement plan you choose, your contributions may be tax-deductible, or they may grow tax-free until withdrawal. Additionally, some retirement plans offer employer matching contributions, further enhancing your tax benefits.

Web ID Pro can assist you in evaluating your retirement planning options and help you identify the retirement plan that best aligns with your financial goals. Our knowledge and experience in business and consumer services make us the ideal partner to guide you through the complexities of maximizing your retirement plan deductions.

Conclusion

Utilizing these 3 powerful tax deductions can have a massive impact on reducing your taxes. The home office deduction, business vehicle expense deduction, and retirement plan contributions are key strategies to consider when looking to maximize your tax savings.

At Web ID Pro, we understand the intricacies of tax planning and can provide expert guidance to ensure you're taking full advantage of these deductions. As leaders in website development and business and consumer services, we specialize in helping individuals and businesses optimize their tax strategies for maximum benefit. Contact us today to learn how we can assist you in reducing your taxes and achieving your financial goals.

About Web ID Pro

Web ID Pro is a leading provider of business and consumer services, specializing in website development. Our team of experts is dedicated to delivering outstanding results and helping our clients succeed in their online ventures.

- Expertise in website development, design, and maintenance

- Customized solutions tailored to your specific needs

- Passionate about driving your online presence

- Committed to delivering exceptional service

Partner with Web ID Pro today and experience the difference our expertise can make in your online journey. Contact us for a consultation and let us help you achieve your business goals.